Summary

- Altria has had a difficult year, however, despite that, the company remains a great investment for the 2020s.

- The company has strong earnings potential, and its earnings should continue going forward. This supports its dividend of more than 8%, which should continue.

- On top of its single digit P/E ratio, the company has significant growth opportunities in its business through marijuana and alcohol.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

At the start of 2020, we recommended Altria (NYSE: MO) as a great investment for the 2020s. From that point, the company had a rough 2020. 2020 was a year where value stocks were punished and growth stocks took off. However, despite that, as we'll see throughout this article, Altria's growth potential make the company a valuable investment opportunity for the 2020s.

Altria Earnings

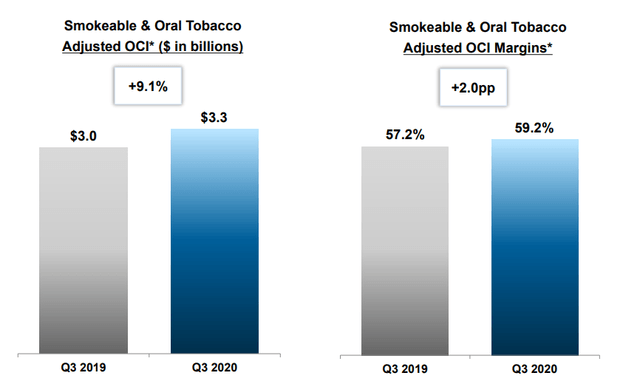

Altria has been focused on both generating strong earnings, and maintaining its strong margins.

Altria Earnings Margins - Altria Investor Presentation

The company's smokeable and oral tobacco segments have near 60% margins supporting adjusted OCI of roughly $3.3 billion. There's two important key takeaways here for investors looking at the company as a high potential long-term investment. The first is the company managed to improve margins YoY during a difficult time.

The second is that the company managed to grow adjusted OCI by much more than what's implied solely by the company's margins. Overall, the company's smokeable products segment experienced strong growth. That's because COVID-19 cut smoking product decline rates to near 0. For the smokeable products segment, it went down 2% versus 0% for the industry.

The overall strength of the company during the difficult year highlights its ability to drive shareholder returns.