Six health caredividend stocks to own during the ongoing COVID-19 pandemic recovery encompass companies that focus on helping patients and providing them with prescription drugs that are developed to alleviate serious ailments and diseases.

The six health caredividend stocks to own should rise past weakened economic activity in states throughout the country where their governors imposed restrictions starting in March when the number of COVID-19 cases and deaths spread shockingly. These six health care dividend stocks to own stand out for their potential in an industry that has taken on enhanced importance as the novel coronavirus worsened.

COVID-19 has caused 11,948,281 cases and 546,601 deaths globally, along with 3,097,084 cases and 133,972 lives lost in the United States, as of July 7. America has more than double as many cases and deaths of any other nation, including China, where COVID-19 originated.

Six Health Care Dividend Stocks to Own Feature Bristol Myers

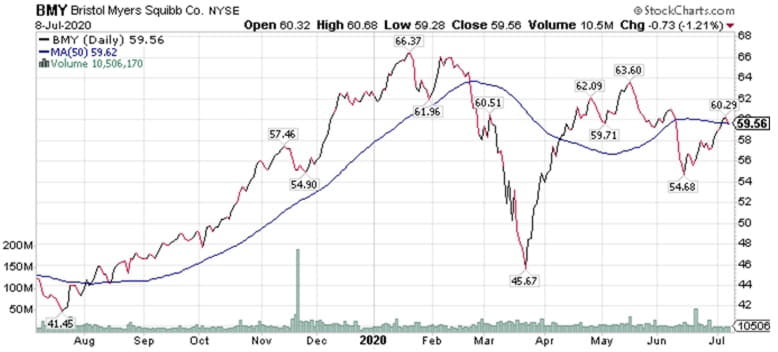

Bob Carlson, head of the Retirement Watch advisory service and chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, spoke positively of Bristol-Myers Squibb Co. (NYSE:BMY). The pharmaceutical developer and manufacturer recently overcame problems such as patent losses and huge debt to buy Celgene, but its stock price dropped and left BMY valued at a deep discount, he added.

But Bristol-Myers Sqiubb has a dividend yield of 3.03% that appears safe, even after the debt payments due to its Celgene deal, Carlson continued. In fact, S&P maintained the company’s A+ debt rating.

Chart courtesy of www.StockCharts.com

“The company is selling other assets and reducing expenses to increase cash flow,” Carlson said. “BMY made deleveraging and improving its balance sheet a priority.”

BMY also has a portfolio of profitable drugs and a solid pipeline of others on the way, Carlson continued.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

Bristol-Myers Squibb has at least preserved its dividend for more than 35 years and boosted it each of the last 13 years, Carlson said. Thus, it is a stock that income investors should appreciate.

A big “risk” in owing Bristol-Myers Squibb shares is whether the company will execute its merger plan well or remain burdened with debt from the Celgene deal, Carlson told me. The risk has a low probability of occurring, given the company’s successful track record with executing mergers, he added.

AstraZeneca Is Another of the 6 Health Care Dividend Stocks to Own

Bryan Perry, who leads the Cash Machine, Premium Income, Quick Income Trader, Hi-Tech Trader and Breakout Profits Alert advisory services, told me he likes AstraZeneca plc (NYSE:AZN) and Johnson & Johnson (NYSE:JNJ).

“In looking at the leading candidates to bring a COVID-19 vaccine to market, AstraZeneca’s experimental COVID-19 vaccine is probably the world’s front-runner and most advanced in terms of development,” according to the World Health Organization’s (WHO) chief scientist, Perry told me. “The British drug maker has already begun large-scale, mid-stage human trials of the vaccine.”

AstraZeneca also announced that it signed supply chain agreements with Brazil’s Fundação Osvaldo Cruz, also known as Fiocruz, the nation’s top public health organization, for the capacity to produce 2 billion doses of its potential coronavirus vaccine, known as AZD1222, which was developed by researchers at University of Oxford, Perry continued. Plus, AZN offers a dividend yield of 2.57%.

A potential vaccine for COVID-19 gains efficacy with a second dose, according to reports. In addition, the AstraZeneca partnership with Moderna (NASDAQ:MRNA) has begun talks with Daiichi Sankyo to supply the novel coronavirus vaccine in Japan.

Chart courtesy of www.StockCharts.com

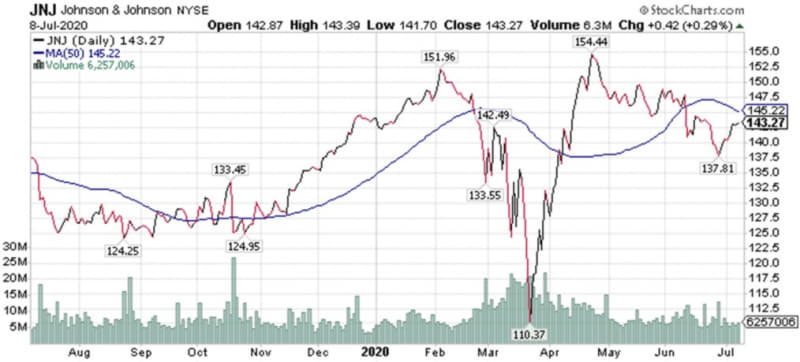

Johnson & Johnson Joins 6 Health Care Dividend Stocks to Own

A key reason Perry said he likes Johnson & Johnson as one of the top health care dividend stocks to own is that its COVID-19 vaccine candidate is a frontrunner in the race for a treatment or a cure. Through its Janssen Pharmaceutical Companies, JNJ has accelerated introduction of the Phase 1/2a first-in-human clinical trial of its investigational SARS-CoV-2 vaccine, Ad26.COV2-S, recombinant.

First scheduled to start in September, the trial is now expected to launch in the latter half of July. JNJ also is in talks with the National Institutes of Allergy and Infectious Diseases about initiating the Phase 3 clinical trial ahead of its original schedule, pending the outcome of the Phase 1 studies and approval of regulators.

Chart courtesy of www.StockCharts.com

Another encouraging development is that the United Kingdom is in advanced talks to reserve or buy doses of JNJ’s COVID-19 vaccine. The European Union reportedly has authorized use of an emergency fund of $2.3 billion to reach agreements with up to six COVID-19 vaccine manufacturers. JNJ also offers a current dividend yield of 2.88%.

Paul Dykewicz interviews Bryan Perry at the MoneyShow in Orlando, Florida.

Walgreens is 1 of 6 Health Care Dividend Stocks to Own

Mark Skousen, PhD, likes dividend stocks and one he is recommending to rebound from a drop is Walgreens Boots Alliance (NYSE:WBA). The company is a retail and wholesale pharmacy that owns and operates Walgreens and Duane Reade stores in the United States, Boots stores in Europe and Asia, as well as others.

Walgreens has endured a fall of about 30% in its share price since the start of the year as it slid from $59 to $41.98, on July 2. However, Walgreens pays a current dividend yield of 4.48% and is a top undervalued stock that possesses potential to recover, especially if its ongoing cost-cutting effort pays off.

Chart courtesy of www.StockCharts.com

Skousen, whose flagship investment service is his Forecasts & Strategies investment newsletter, has a five-stock portfolio of dividend-paying companies such as Walgreens, which could be considered a comeback candidate for income investors who can afford to be patient while they collect its dividends.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz in Philadelphia. Skousen’s premium investment services consist of Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert.

“The drugstores were an essential retail channel and so never really shut down in the quarantines,” said Hilary Kramer, host of a national radio program called “Millionaire Maker.”

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services included 2-Day Trader, IPO Edge, Turbo Trader, High Octane Trader and Inner Circle.

But after weathering the worst, the pharmacy services stocks look oversold as the underlying businesses ramp back up, opined Kramer, who also leads the Value Authority and GameChangers advisory services. Investors who already own shares in those stocks should keep them, she advised.

Bank of America Prefers CVS as 1 of the 6 Health Care Dividend Stocks to Own

Bank of America gave CVS Health Corp. (NYSE:CVS) a price objective of $80, roughly 23% above the pharmacy services company’s closing price on Thursday, July 2. Bank of America’s price target is based on roughly 10.5x its 2020 earnings per share (EPS) estimate.

“This multiple is below the five-year average on an absolute basis and at the lower end of the historical range of 11.0x-17.5x,” according to a recent research note from Bank of America. “This also represents a bigger discount to the S&P 500 vs. the last five years. The discount reflects margin pressure across CVS's core Pharmacy Services and Retail Pharmacy segments and uncertainty around drug prices.”

Downside “risks” to CVS achieving that price level include the possibility of Amazon (NASDAQ:AMZN) or another disruptive force entering the supply chain, failure to generate expected synergies from its Aetna transaction, any regulatory issues related to post-closing activities of that deal and growing competitive risks in the pharmacy benefit market. Further risks include the highly competitive long-term care pharmacy business, business disruption tied to the COVID-19 outbreak and slowing prescription/insurance trends.

Possible catalysts to lift CVS are a potential prescription volume pickup, faster-and-stronger-than-expected synergies from Aetna and improving front-end performance, Bank of America added. CVS also offers a dividend yield of 3.10%.

Chart courtesy of www.StockCharts.com

Stocks achieved a remarkable recovery in the second quarter ended June 30 after a COVID-19-related market crash in March of first-quarter 2020. In fact, Q2 marked the best-performing quarter for the market since 1998 and the strongest second quarter on record, with the S&P 500 soaring nearly 20%, while the Dow Jones Industrial Average and the NASDAQ Composite climbed 17.5% and 30%, respectively.

These six health care dividend stocks to own offer investors a chance to profit from the COVID-19 recovery as non-essential businesses reopen and begin to recall many employees who had been laid off during the recent lockdowns. Investors can take heart from the U.S. unemployment rate dipping to 11.1% as the economy added 4.8 million jobs in June, the Bureau of Labor Statistics announced on July 2. That data topped the predictions of many economists.

To read Paul’s latest dividend investing columns, please click here.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce,Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is endorsed by Joe Montana, Joe Theismann, Ara Paseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Follow Paul on Twitter@PaulDykewicz.