Ten health care stocks to purchase during the ongoing recovery from the COVID-19 pandemic target companies aimed at treating patients and giving them prescription drugs to help alleviate serious ailments and diseases.

The ten health care stocks to purchase factor in the effect of governors around the country imposing restrictions in March when the number of COVID-19 cases and deaths spiked. These 10 health care stocks to purchase stand out for their potential in an industry that has gained increased importance as the novel coronavirus crisis worsened.

The fallout of COVID-19 has included 10,815,117 cases and 519,575 deaths worldwide, along with 2,732,639 cases and 128,677 lives lost in the United States, as of July 2. America has more than double as many cases and deaths of any other nation, including China, where COVID-19 originated. Plus, a one-day spike in cases occurred in Florida, Georgia, Idaho, Tennessee and Utah on June 26 following recent public protests, reopening of businesses and resumption of activities in which many people chose not to use protective masks and social distance, as recommended by public health experts.

Ten Health Care Stocks to Purchase Include Bristol Myers

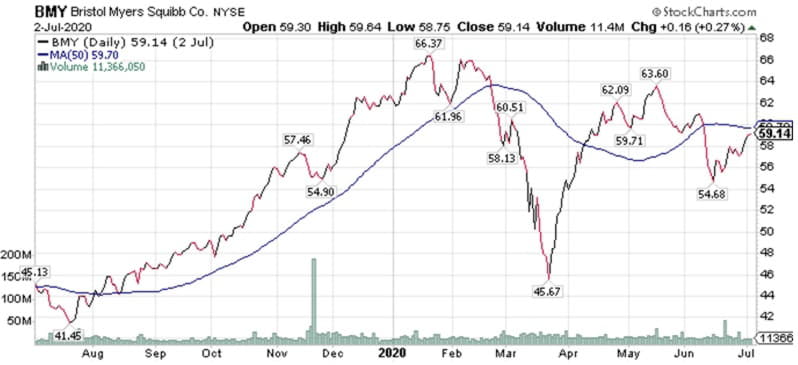

Bob Carlson, leader of the Retirement Watch advisory service and chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, suggested purchasing Bristol-Myers Squibb Co. (NYSE:BMY). The pharmaceutical developer and manufacturer had some problems recently such as patent losses and the assumption of heavy debt to buy Celgene that slammed its stock price and left it selling for a huge discount to its prior value, he added.

But BMY has a high dividend yield of around 3.11% that looks to be safe, even after the debt payments from the Celgene deal, Carlson counseled. In fact, S&P continued to give the company’s debt an A+ rating after the deal.

Chart courtesy of www.StockCharts.com

“The company is selling other assets and reducing expenses to increase cash flow,” Carlson said. “BMY made deleveraging and improving its balance sheet a priority.”

Bristol-Myers has a history of managing mergers and acquisitions well, so it is likely to achieve the cost savings and benefits it expects from the Celgene deal, Carlson predicted. BMY offers a good portfolio of profitable drugs and a solid pipeline of more ahead, he added.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19

The company has at least maintained its dividend for more than 35 years and increased it each of the last 13 years, Carlson said. It is a stock that income investors should like.

The “main risk” in purchasing BMY today is whether it will execute its merger plan well or remain burdened with debt from the Celgene deal, Carlson told me. The risk has a low probability of occurring, given the company’s history of successfully executing mergers, he added.

Vaccine Developer AstraZeneca Is One of the Ten Health Care Stocks to Purchase

Bryan Perry, who leads the Cash Machine, Premium Income, Quick Income Trader, Hi-Tech Trader and Breakout Profits Alert advisory services, told me he likes AstraZeneca plc (NYSE:AZN) and Johnson & Johnson (NYSE:JNJ).

Paul Dykewicz interviews investment guru Bryan Perry at the Orlando MoneyShow

“In looking at the leading candidates to bring a COVID-19 vaccine to market, AstraZeneca’s experimental COVID-19 vaccine is probably the world’s front-runner and most advanced in terms of development, the World Health Organization’s (WHO) chief scientist said,” Perry told me. “The British drug maker has already begun large-scale, mid-stage human trials of the vaccine.”

AstraZeneca also signed supply chain deals with Brazil’s Fundação Osvaldo Cruz, also known as Fiocruz, the country’s leading public health organization, for the capacity to produce 2 billion doses of its potential coronavirus vaccine, known as AZD1222, which was developed by researchers at University of Oxford, Perry continued. Plus, AZN sports a dividend yield of 2.59%.

The potential vaccine for COVID-19 becomes yet more effective in improving the immune response with a second dose, according to reports. Plus, the AstraZeneca partnership with Moderna (NASDAQ:MRNA) has begun talks with Daiichi Sankyo to supply their promising novel coronavirus vaccine in Japan.

Chart courtesy of www.StockCharts.com

The Forecasts & Strategies investment newsletter of Mark Skousen, PhD, also includes a promising health care stock recommendation that he shared with me.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz in Philadelphia. Skousen’s premium investment services consist of Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert.

Money Manager Hilary Kramer Offers Four of the Ten Health Care Stocks to Purchase

Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the Value Authority and GameChangers advisory services, provided four recommendations for the ten health care stocks to purchase now.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services included 2-Day Trader, IPO Edge, Turbo Trader, High Octane Trader and Inner Circle.

Investors who may follow the Wall Street adage of “sell in May and go away” would have missed out on the recent market resurgence but there still is time to purchase the ten health care that hold promise for future profitability.

To read the rest of Paul’s investment column, please click here.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce,Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.The book is endorsed by Joe Montana, Joe Theismann, Ara Paseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.