Summary

- Atlantic Union Bankshares Corp.'s new preferred stock, AUBAP, is trading at a Current Yield of 7.05%.

- The company's equity is enough to cover its liabilities.

- I compare AUBAP with all other fixed-rate preferred stocks issued by a bank.

- I do much more than just articles at Trade With Beta: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Introduction

With all major indexes making new highs every day, driving the equities into an impressive bull market. The fixed-income securities also do not miss the momentum to perform and almost complete recovery from the massive sell-off early this year. In addition to the price recovery, we are also seeing a recovery in terms of offerings in the primary market. Since May, several companies issued their preferred stock IPOs on the National Exchange for the first time. In this article, we want to introduce you the newest preferred stock IPO issued by Atlantic Union Bankshares Corporation (AUB), to see how it holds up against its peer group, and to determine whether it will find its place in our portfolio or if there is a better alternative.

The New Issue

Before we submerge into our brief analysis, here is a link to the 424B2 Filing by Atlantic Union Bankshares Corporation - the prospectus.

Source: SEC.gov

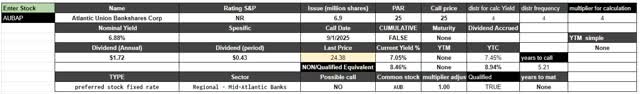

For a total of 6M shares issued, the total gross proceeds to the company are $150M. You can find some relevant information about the new preferred stock in the table below:

Atlantic Union Bankshares Corporation 6.875% Perpetual Non-Cumulative Preferred Shares, Series A (NASDAQ: AUBAP) pays a qualified fixed dividend at a rate of 6.875%. The new preferred stock has no Standard & Poor's rating and is callable as of 09/01/2025. AUBAP is currently trading below its par value at a price of $24.38. This translates into a 7.05% Current Yield and a YTC of 7.45%

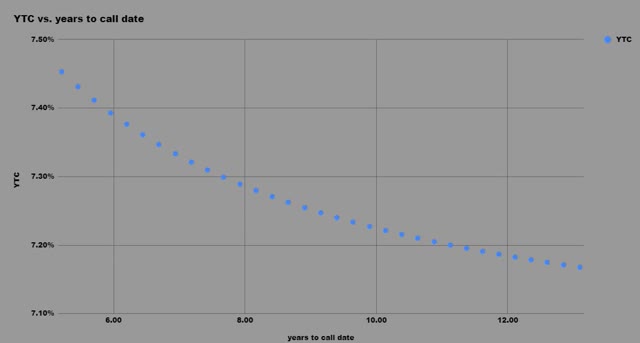

Here's how the stock's YTC curve looks right now:

The Company

Our mission is to create value for you, our shareholder, over the long term. We are pleased to have you as a shareholder and grateful for the confidence you have demonstrated by entrusting us with your investment. This section of our website is designed to answer the questions most often asked about stock ownership within our company.

Headquartered in Richmond, Virginia, Atlantic Union Bankshares Corporation [Nasdaq: AUB] is the holding company for Atlantic Union Bank. Atlantic Union Bank has 149 branches and approximately 170 ATMs located throughout Virginia, and in portions of Maryland and North Carolina. Middleburg Financial is a brand name used by Atlantic Union Bank and certain affiliates when providing trust, wealth management, private banking, and investment advisory products and services. Certain non-bank affiliates of Atlantic Union Bank include: Old Dominion Capital Management, Inc., and its subsidiary, Outfitter Advisors, Ltd., Dixon, Hubard, Feinour & Brown, Inc., and Middleburg Investment Services, LLC, which provide investment advisory and/or brokerage services; and Union Insurance Group, LLC, which offers various lines of insurance products.

Source: Company's website | Corporate Profile