Invest in e-commerce growth to profit from a powerful trend that has gained momentum during the COVID-19 pandemic, advises Kevin O’Leary, a major investor who is a panelist on the “Shark Tank” television program and chairman of O’Shares ETFs.

A way to invest in e-commerce growth is through the O’Shares Global Internet Giants ETF (NYSE ARCA:OGIG), singled out by O’Leary as O-Shares ETFs’ “best-performing asset” with a 26.56% rise in its share price so far this year. O’Leary, nicknamed “Mr. Wonderful” on the “Shark Tank” program, shared a story during a recent video conference call with ETF Trends about Lovepop, a pop-up greeting card company he agreed to help fund, that beat its expected April sales by marketing directly to its customers rather than rely on its traditional retail sales channels amid an economic shutdown.

Chart Courtesy of www.StockCharts.com

OGIG is among the market-leading technology investments that have beaten the performance of the major U.S. stock indexes so far this year, as well as gold, silver and oil. The fund has risen 5.5% more than the 21.06% gain of the technology category thus far in 2020.

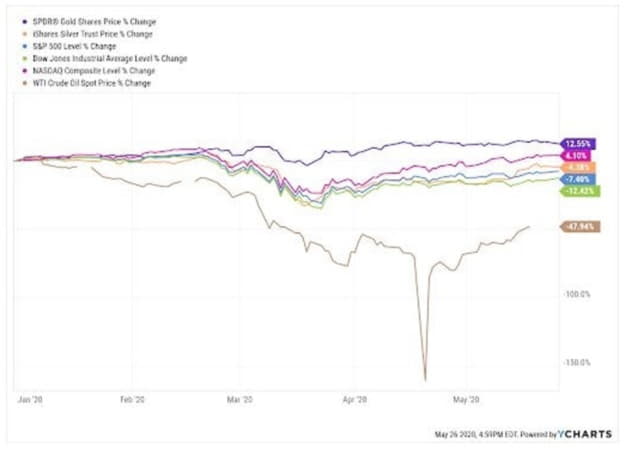

Chart courtesy of www.YCharts.com

Large and small companies alike are showing it pays to invest in e-commerce growth, O’Leary said. Before the pandemic, a typical consumer goods company might have produced sales that came 50% from traditional retail, 40% from Amazon and 10% direct to the consumer through its website.

“That would be a typical model,” O’Leary said.

Paul Dykewicz meets with Kevin O’Leary for an interview before COVID-19 social distancing.

Hilary Kramer, host of a national radio program called“Millionaire Maker” and head of the Value Authority and GameChangers advisory services, said 2020 has become the year direct-to-consumer retail comes into its own. With so many stores closed and supply chains stretched thin amid the current public health crisis, many consumer brands have reconsidered why they need to sell through intermediaries, she added.

Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader,High Octane Trader and Inner Circle.

Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, said the pandemic has sped up several trends, including investment in e-commerce growth, that otherwise would have taken five to 10 years to go mainstream.

“Increased use of technology, remote work and less need for retail and office space are foremost among those trends,” said Carlson, who also leads the Retirement Watch advisory service.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

To read the rest of Paul’s investment column, please click here.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce,Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.The book is endorsed by Joe Montana, Joe Theismann, Ara Paseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.