Six gold investments to buy to curb the worst of the COVID-19 fallout include four mining stocks, quality coins and Perth Mint certificates backed by the precious metal itself.

These six gold investments to buy offer ways to gain exposure to the appreciation potential of the precious yellow metal, while reining in the risk of miners working near each other amid limited space for social distancing. Two non-equity ways to invest in gold only offer minimal risk to COVID-19 for investors who want an alternative to the possibility of a virus outbreak in mining operations around the world that might cause extended shutdowns.

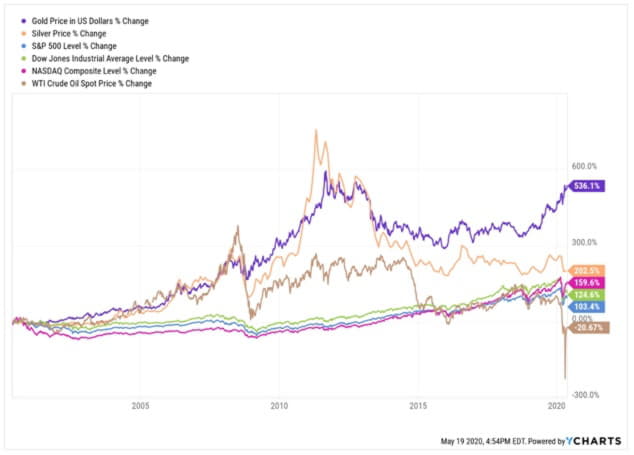

However, the four mining stocks included among the six gold investments to buy have shown that it is possible to respond to instances of COVID-19 among their employees and take action to halt the spread of the disease. During the past 20 years, gold has risen 164.7% more than silver, jumped 235.9% further than NASDAQ, leaped 330.3% beyond the Dow Jones Industrial Average, soared 418.5% higher than the S&P 500 and trounced the falling price of oil.

Chart courtesy of www.YCharts.com

Barrick Gold Is One of 6 Gold Investments to Buy to Curb the Risk of COVID-19

Toronto-based Barrick Gold Corp. (NYSE: GOLD), the second-largest mining company headquartered in the United States, has been recommended in the Five Star Trader advisory service for less than two months and already is up 40% in that time. Barrick Gold is the top-performing recommendation in the Five Star Trader service of economist Mark Skousen, PhD, a Presidential Fellow at Chapman University, recipient of the inaugural Triple Crown in Economics in 2018 and one of the 20 most influential living economists.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz in Philadelphia.

“Gold is an age-old storehouse of wealth,” said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the Value Authority and GameChangers advisory services. “If you’re primarily worried about losing what you have to inflation, a slowing economy or even social upheaval, this is your shield.”

Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader,High Octane Trader and Inner Circle.

To read the rest of Paul’s investment column, please click here.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce,Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz.The book is endorsed by Joe Montana, Joe Theismann, Ara Paseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.