Summary

- For less than 7x free cash flow, investors can purchase a growing company run by shareholder friendly management.

- Discovery's competitive position is often overlooked when grouped with other linear programming-dependent peers.

- John Malone placed a large bet at recent prices that Discovery will succeed in monetizing the Direct to Consumer segment.

- Risks exist in a rapidly changing media environment but are largely offset by valuation.

Overview

Discovery, Inc. (NASDAQ:DISCA) is an interesting investment at current prices amidst an evolving media landscape. Selling for less than 7x free cash flow, the market is pricing in terminal decline for Discovery’s business. Discovery has taken a different approach to the changing media environment, a path that has so far proven successful.

If the management team continues to execute its strategy in traditional linear cable as well as direct to consumer (DTC) segments, annual returns to shareholders could easily exceed 20%.

Discovery offers investors the chance to invest alongside famed media “Outsider”, John Malone, who has been a significant buyer of the stock in recent months.

Background

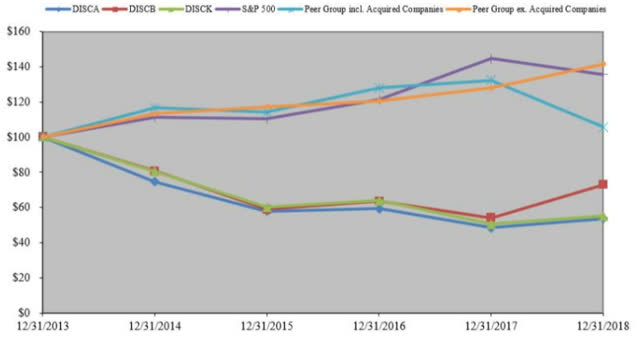

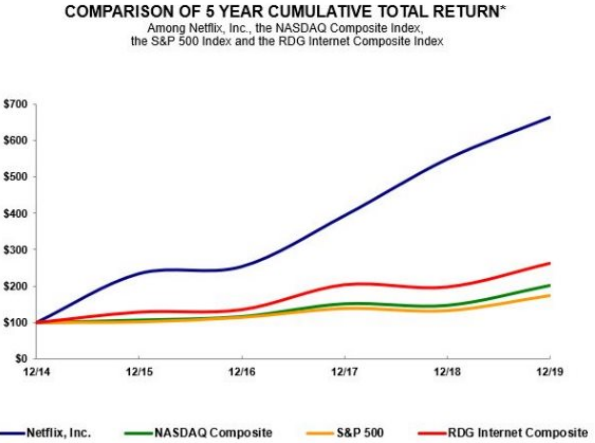

Discovery competes in the media industry against the likes of Walt Disney (NYSE:DIS), Netflix (NASDAQ:NFLX), ViacomCBS (NASDAQ:VIAC), AT&T (NYSE:T), and many others. Stocks in this segment have been bifurcated between the haves and the have-nots as cord cutting has accelerated in recent years. A look at a comparison between Discovery and its peer group (legacy linear cable-dependent companies) against Netflix stock performance over the past several years tells the story. Not to compare Discovery to Netflix, but I believe Discovery is being inappropriately discounted which has created an opportunity for long-term investors.

Figure 1: Discovery Stock Performance. Source: Discovery 10K

Figure 2: Netflix Stock Performance. Source: Netflix 10K

Discovery owns several well-known U.S. brands across multiple segments. These include Discovery Channel, TLC, Animal Planet, Investigative Discovery, HGTV, Food Network, and the Travel Channel. Its international brands include Eurosport, DMAX, and TVN. The company operates in over 200 markets worldwide and retains ownership of virtually all content and IP.

Discovery essentially makes money in two ways – advertising and distribution. The company earns revenue from advertising fees for advertising space sold on their networks and digital products as well as from fees charged to distributors (such as cable and satellite companies) to use their first-run content.