SALES ACTIVITY PICKS UP IN EARLY PART OF THE YEAR

The Washington metro area condo market began 2018 with an increase in sales activity and price growth, amid a decrease in available inventory. A number of submarkets remain supply-constrained, particularly in Northern Virginia. After a brief lull in construction activity in 2017, we expect starts in 2018 to rebound to go along with an increase in sales activity. Price growth should continue to be moderate in the first few quarters of 2018 before accelerating later in the year and into 2019.

FIRST QUARTER 2018 HIGHLIGHTS

Sales:Metro-wide there were 432 new unit sales during the first quarter of 2018. Net condo sales over the past 12 months were 1,510, down 17% from the prior 12-month period. This was the best-performing quarter in nearly two years and the strongest first quarter since 2013.

Prices:Effective prices for “same-store” condos increased by 2.1% over the past 12 months, with prices increasing at a faster rate in the District and Northern Virginia. As of the first quarter of 2018, the region’s highest effective prices per square foot continue to be in Upper NW DC (where all sales are in high-end luxury buildings). The lowest average prices are in Loudoun/Prince William (with mostly townhouse-style units marketing).

Concessions:Average concession rates (as a percentage of asking price) are 0.7% as of the first quarter of 2018, down 30 basis points from a year prior.

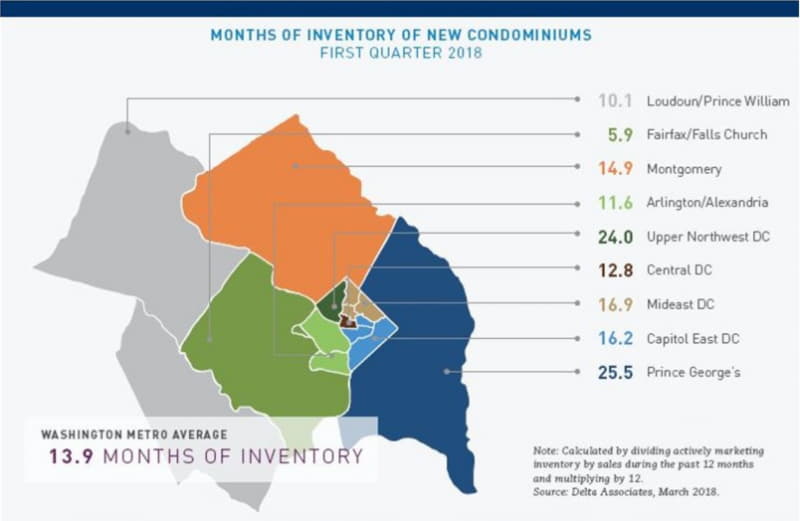

Pipeline:Unsold units in projects currently marketing or under construction (and not yet marketing) number 2,732 units as of March 2018, an increase of 6% from a year ago. Currently, the submarkets with the largest available inventory are Capitol East DC (744 units), Prince George’s (634 units), and Fairfax/Falls Church (279 units).

Starts:A total of 1,638 started construction in 2017, below the 1,838 units that broke ground in 2016. Northern Virginia led the region in new starts with 651 units, followed by the District with 501, and Suburban Maryland with 486. We expect starts to rebound in 2018 with over 2,100 units projected to start construction, concentrated in the District and Northern Virginia.

Deliveries:Deliveries dropped to 835 units in 2017 from 1,355 in 2016. Much of this can be attributed to the fact that widespread high-rise condo construction has yet to fully return to the metro area during the post-recession recovery. However, we project a rebound in deliveries in 2018 with nearly 1,700 units expected to deliver in the region(excluding potential condo switches), mostly in the District and Suburban Maryland.

Delta Associates, the research affiliate of Transwestern, is a firm of experienced professionals which has been providing consulting and subscription data services to the commercial real estate industry for over 35years.

Please visit our website at DeltaAssociates.com and follow us on Twitter (@DeltaAssociates) for additional market insight and information about our services.