Coworking, incubator and tech-sector leading market lead growth in Q2 2016

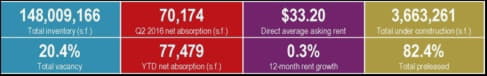

Strong job growth has fueled expansion activity within emerging segments of the tenant base despite suppressed tenant demand and consolidation within the legal and government sectors of the Metro DC office market, according to JLL Research’s Q2 reports.

Over the past 18 months, nearly half of the region's expansionary leasing activity has fallen within the coworking, incubator and TAMI (technology, advertising, media and information) segments. The growth of entities such as WeWork, MakeOffices, Spaces and Eastern Foundry represent an emerging segment of the market that now totals over 1.8 million square feet. The report also notes that during the second quarter of 2016, growing tenants outnumbered shrinking tenants by a 6.6% margin.

“There has been a dramatic shift in the regional market drivers – law firms and the federal government have been largely on the sidelines this year,” Scott Homa, Senior Vice President, Mid-Atlantic Research, JLL.“Although these traditional catalysts are dormant in DC, we are seeing strong leasing velocity in Northern Virginia and Suburban Maryland. There has been rapid life science expansion along the I-270 Corridor, and leasing activity is brisk in Northern Virginia, where tenants are jockeying for space along the Silver Line Corridor.”

Although an urban migration trend has benefitted the District of Columbia in recent years, the geographic scope of leasing activity continues to widen, and Suburban Maryland and Northern Virginia each outpaced the District of Columbia in leasing velocity during Q2 2016.

Washington, D.C.

- Law firm leasing activity in the second quarter was confined to deals under 50,000 square feet and only one law firm lease greater than 50,000 square feet has been signed YTD.

- The pipeline of law firm lease expirations is thin until 2019.

- Developers broke ground on eight new projects totaling 2.8 million square feet during Q2 2016.

- Washington, DC net absorption year to date: -372,745 square feet.

Suburban Maryland

- From 2011 through 2015, the government accounted for 62.8 percent of all leases greater than 50,000 square feet but this trend has shifted in 2016, with private-sector companies securing 66.4 percent of all large deals in Q2 2016.

- Three private sector biopharmaceutical and health related companies each signed deals in excess of 100,000 square feet in Montgomery County.

- Of the 39 large blocks (more than 50,000 square feet) of Class A space available, 71.8 percent are not located near a Metro station.

- Suburban Maryland net absorption year to date: 647,090 square feet.

Northern Virginia

- A variety of technology companies, government contractors, nonprofits and professional services firms were active in Northern Virginia where 41 leases over 20,000 feet were signed during the second quarter of 2016, which is nearly double the quarterly average in Northern Virginia.

- Of those leases, 65.8 percent were located along the Silver Line corridor between Rosslyn and Herndon.

- Since the start of 2015, there has been over 1.8 million square feet of positive net absorption in buildings located within 1Ž2 a mile of a Metro station, while off-Metro buildings posted nearly 1.3 million square feet of negative net absorption.

- Northern Virginia net absorption year to date: 77,479 square feet.

“With eight groundbreakings in downtown DC this quarter, we expect to see supply outstrip demand over the next 24-36 months,” added Homa. “Although tenants will encounter more large-block space options in high-quality buildings, much of this new product will be priced 15 to 25 percent above prevailing market averages, which we expect to drive more competition for Class B and C product in good locations.”

About JLL

JLL (NYSE: JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. A Fortune 500 company with annual fee revenue of $5.2 billion and gross revenue of $6.0 billion, JLL has more than 280 corporate offices, operates in more than 80 countries and has a global workforce of more than 60,000. On behalf of its clients, the firm provides management and real estate outsourcing services for a property portfolio of 4.0 billion square feet, or 372 million square meters, and completed $138 billion in sales, acquisitions and finance transactions in 2015. Its investment management business, LaSalle Investment Management, has $58.3 billion of real estate assets under management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit www.jll.com.